First Time Home Buyer Stamp Duty Exemption Malaysia 2019

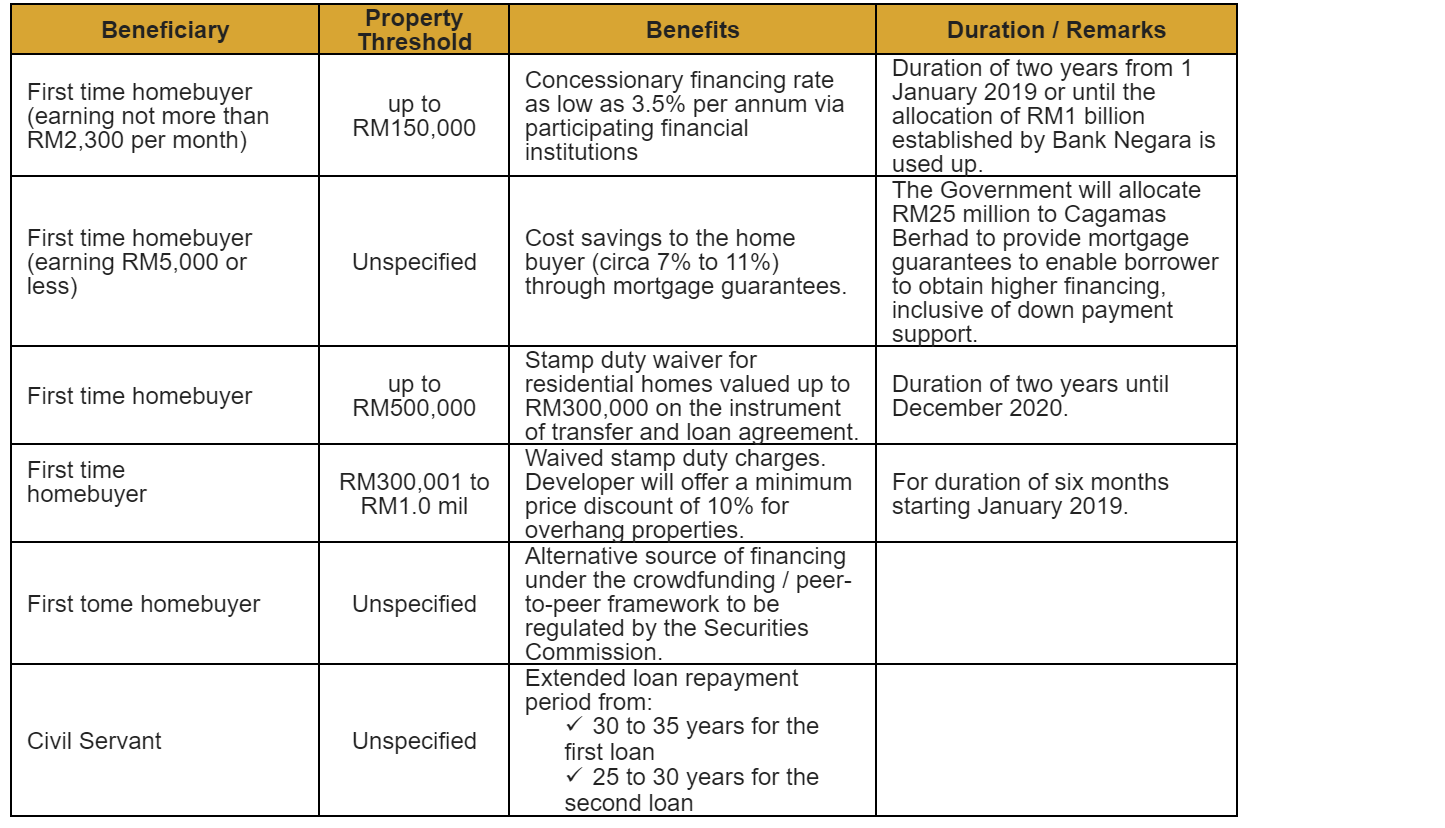

The finance minister had announced during his budget 2019 speech that first time house buyers can enjoy 100 exemption on stamp duty on residential properties if the sales and purchase agreement.

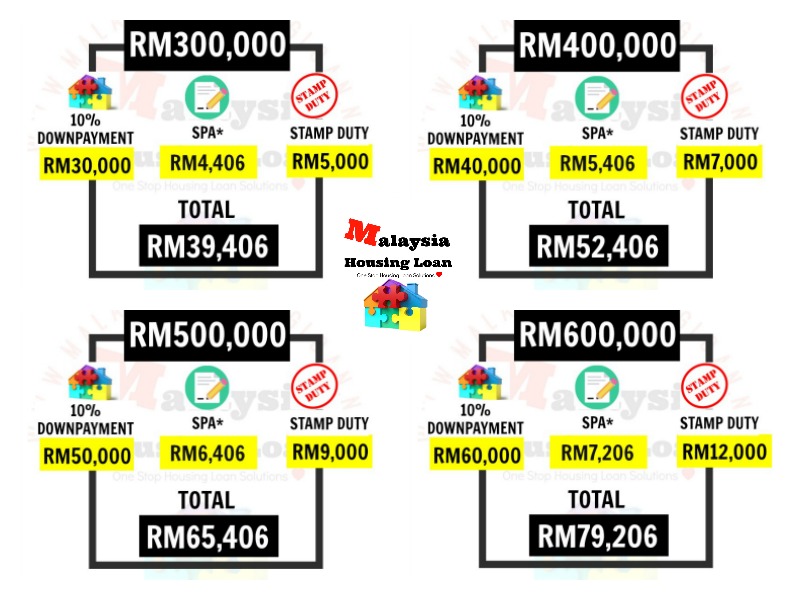

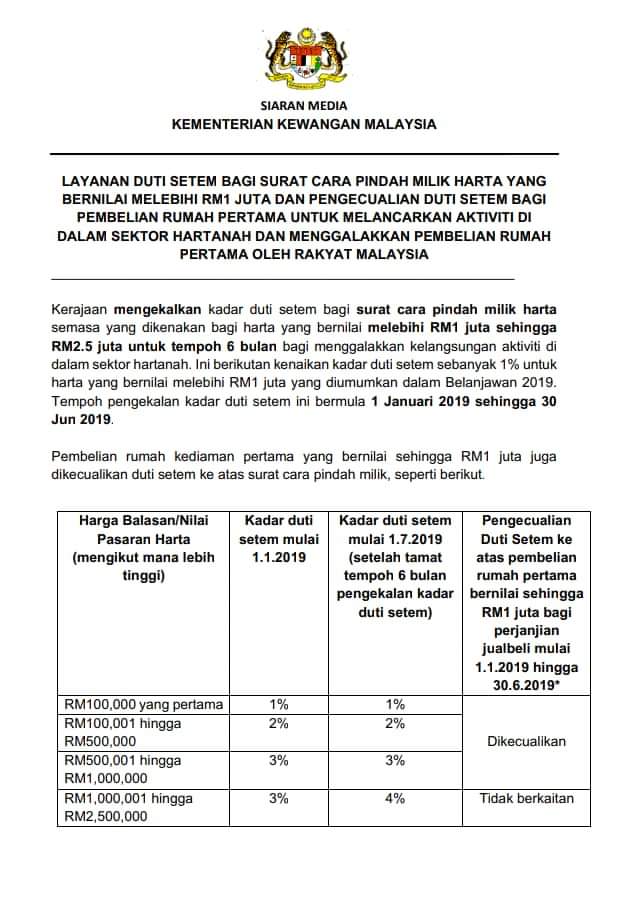

First time home buyer stamp duty exemption malaysia 2019. 1 jan 19 30 jun 19 2 transfer instrument 14a doa shall be stamped on or before 30 june 2019. Full stamp duty exemption on transfer instrument 14a doa ppp rm2 5 million. In the budget 2019 the finance minister of malaysia announced that as one of the measures to address the issue of property overhang the government will waive stamp duties for first time purchases of homes valued between rm300 001 and rm1 million under the national home ownership campaign 2019 nhoc 2019. Professional legal fees to be included 6 of sst.

In this article we compiled a guide for you about the 2019 stamp duty exemption for first time home buyers. Rm100 001 to rm500 000 stamp duty fee 3. With the generosity of malaysian government and to increase the purchasing house for first time house buyer the government had implemented a stamp duty exemption started 2019 until 31st december 2020. For purchases of between rm300 001 and rm500 000 a similar stamp duty waiver is applicable limited to only the first rm300 000 of the house price.

Criteria for first time house buyer stamp duty waiver. In an effort to reduce the cost of ownership for malaysian first time home buyers stamp duties will be exempted up to rm300 000 on the sale purchase agreements and loan agreements for a period of 2 years until december 2020. 1st january 2019 to 30th june 2020. 2020 stamp duty scale from 1st july 2019 stamp duty fee 1.

First time homebuyers will be fully exempted from paying stamp duty for properties up to rm1mil from jan 1 says the finance ministry. In an effort to reduce the cost of ownership of first home for malaysian citizens the government has proposed the following stamp duty exemptions effective date. Must be first time house buyer. Never buy a house before and never inherited any property.

First time homebuyers get stamp duty exemption on the memorandum of transfer and loan agreement for property purchases priced no more than rm300 000. Disbursement fees to be ranging of rm1000 rm1500 00 based on estimation for first time. 3 malaysian citizen first time home buyer. Adoption of old stamp duty rate of 3 not 4 for the thereafter rm 1 million tier.