Standard Depreciation Rate Malaysia

Ias 16 outlines the accounting treatment for most types of property plant and equipment.

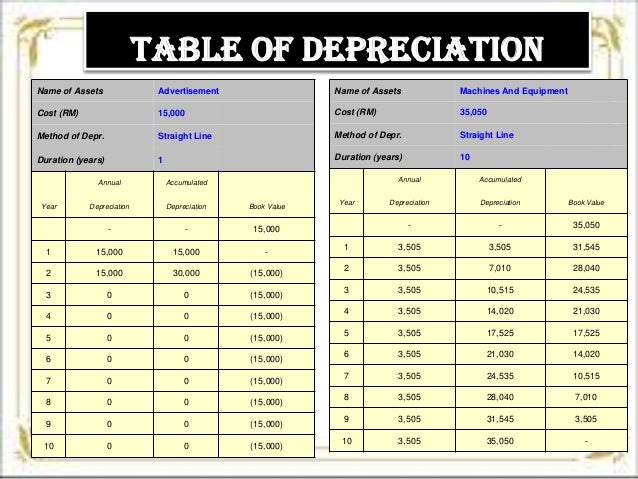

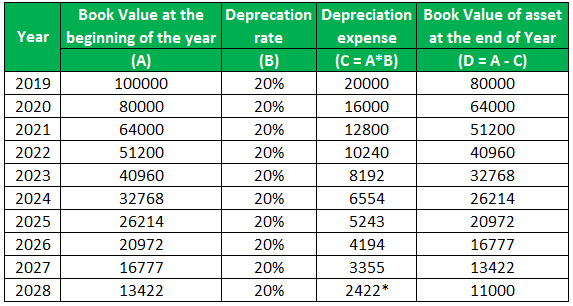

Standard depreciation rate malaysia. Lembaga piawaian perakaunan malaysia malaysian accounting standards board masb standard 15 property plant and equipment any correspondence regarding this standard should be addressed to. Tanks have a useful life of 10 years and a scrap value of 11000. Class of property plant and equipment means a grouping of assets of a similar nature or. Compute the initial carrying value of the factory see solution.

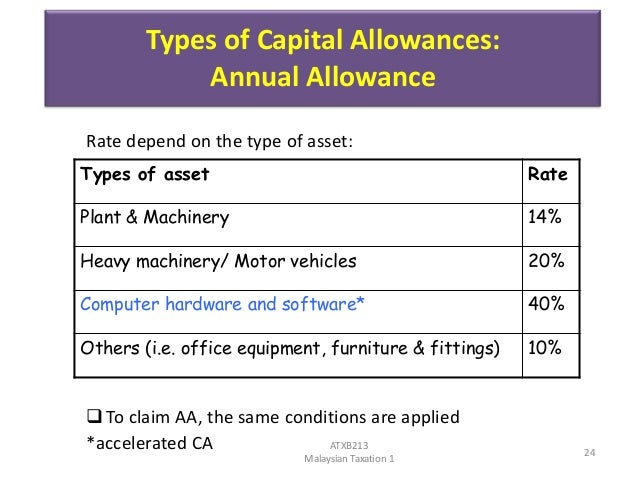

Following are the depreciation rates for different classes of assets. Depreciation of other property plant and equipment is provided on a straight line basis calculated to write off the cost of each asset to its residual value over its estimated useful life. The chairman malaysian accounting standards board suites 5 01 5 03 5th floor wisma maran no. Property plant and equipment is initially measured at its cost subsequently measured either using a cost or revaluation model and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life.

Divide 100 by the number of years in the asset life and then multiply by 2 to find the depreciation rate. An appropriate annual discount rate is 8. If u take 80k for 9 years loan wif 3 5 interest rate totally u will owe the bank 110k. The income tax act 1962 has made it mandatory to calculate depreciation.

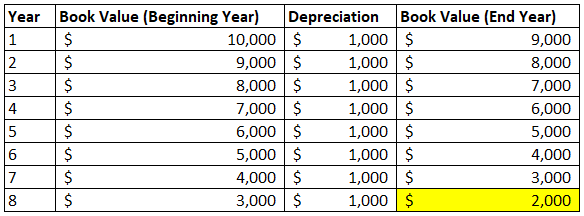

X research source remember the factory equipment is expected to last five years so this is how your calculations would look. The following terms are used in this standard with the meanings specified. Thus depreciation rate during the useful life of vehicles would be 20 per year. Asset type useful life for tax type of tax depreciation method applicable tax depreciation rate comments plant machinery and equipment 10 years except for industrial plants which may be regarded as buildings straight line method 10 other methods could be used e g units of production depreciation method or units of time depreciation.

The expected costs of fulfilling this obligation are 2m. 100 5 years 20 and 20 x 2 40. A public limited liability company and domiciled in malaysia. 338 jalan tuanku abdul rahman 50100 kuala lumpur tel.

Ias 16 was reissued in december 2003 and applies to annual periods. Ias 16 defines depreciation as the systematic allocation of the depreciable amount of an asset over its useful life. During the computation of gains and profits from profession or business taxpayers are allowed to claim depreciation on assets that were acquired and used in their profession or business. A company purchases 40 units of storage tanks worth 1 00 000 per unit.

Buildings on freehold land and leasehold land are amortised at the rate of 2 per annum.