Rental Stamp Duty Calculator Malaysia

The standard stamp duty chargeable for tenancy agreement are as follows rental for every rm 250 in excess of rm 2400 rental.

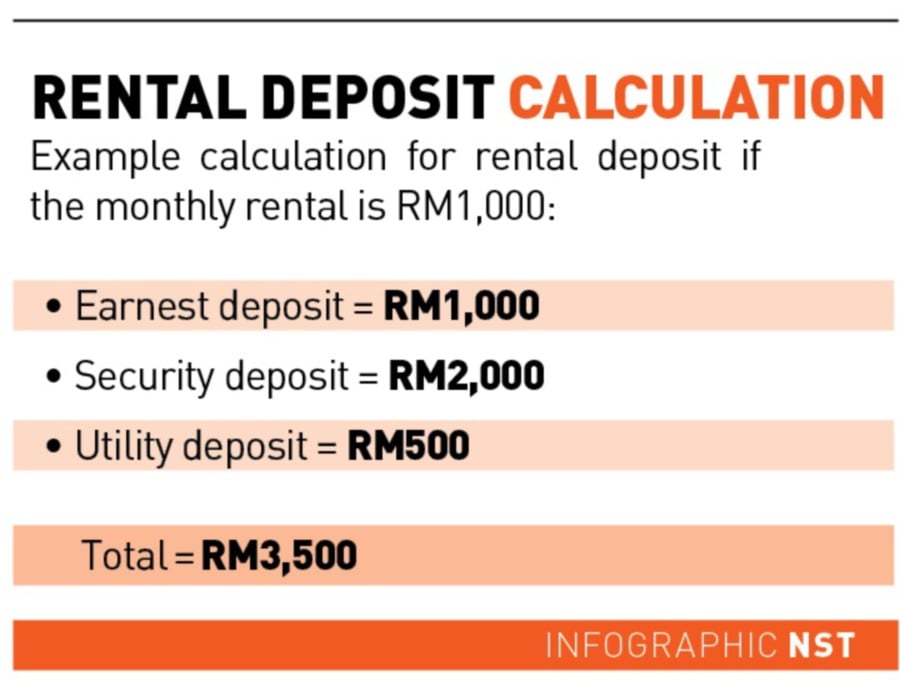

Rental stamp duty calculator malaysia. This is because rm5000 is stamp duty for rm300 000 property value and this is also the maximum amount of the exemption. Rm300 001 to rm500 000 purchase price stamp duty exemption only applicable after 1st july 2019. Calculate the taxable rental. The rental is rm1700 per month for a year renewal.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Next rm 90000 rental 20 of the monthly rent. Based on the table above stamp duty should be rm72 plus rm10 for an additional copy of duplicate agreement. How do i calculate the stamp duty payable for the tenancy agreement.

The first rm2 400 of your annual rental is entitled for stamp duty exemption e g. We recommend you to download easylaw phone app calculator to calculate it easily. For purchase prices between rm100 001 rm500 000 the stamp duty fee is 2 and for purchase prices of rm500 001 and higher the stamp duty fee is 3. Calculate stamp duty legal fees for property sales purchase mortgage loan refinance in malaysia.

First rm 10 000 rental 50 of the monthly rent. So imagine that you are going to buy a new property at a purchase price of rm300. Calculate now and get free quotation. During the tabling of malaysia s budget 2019 it was announced that first time homebuyers would be able to enjoy a stamp duty exemption on the first rm300 000 of the property price on the instrument of transfer and the loan agreement executed between 1 january 2019 and 31 december 2020.

More than rm 100 000 negotiable q. In malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d rental income of the income tax act 1967. Find out this spa stamp duty calculator here. How do i calculate the stamp duty payable for the tenancy agreement.

I am due for my rental renewal and the landlord sent me an electronic tenancy agreement for review with a note to pay for rm150 stamp duty. The standard stamp duty chargeable for tenancy agreement are as follows rental for every rm 250 in excess of rm 2400 rental. For the first rm100 000 the stamp duty fee is 1. You can calculate how much spa stamp duty you need to pay for your house.