Public Bank Personal Loan 2019

Retrieval of loans and securities documents in bank s custody.

Public bank personal loan 2019. Public bank now offers comprehensive financial products and services which includes personal loans credit cards insurance wealth management and more. This personal loan has a maximum tenure of 10 years. Bank islam personal financing i package with bank islam personal financing i package the personal loan comes with an fixed interest rate starting from 4 9 p a. Disbursement charges for loans under contract.

Rm200 00 one off payment 11. Founded in 1966 public bank entered it s 50th year of operation in 2016 and has since grown to service over 9 million customers across the region. Public bank a complete one stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers. It also comes with a minimum income requirement of rm3 000.

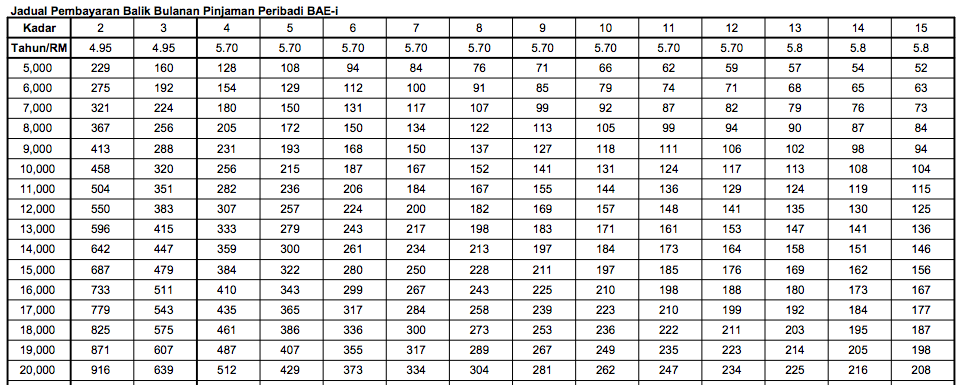

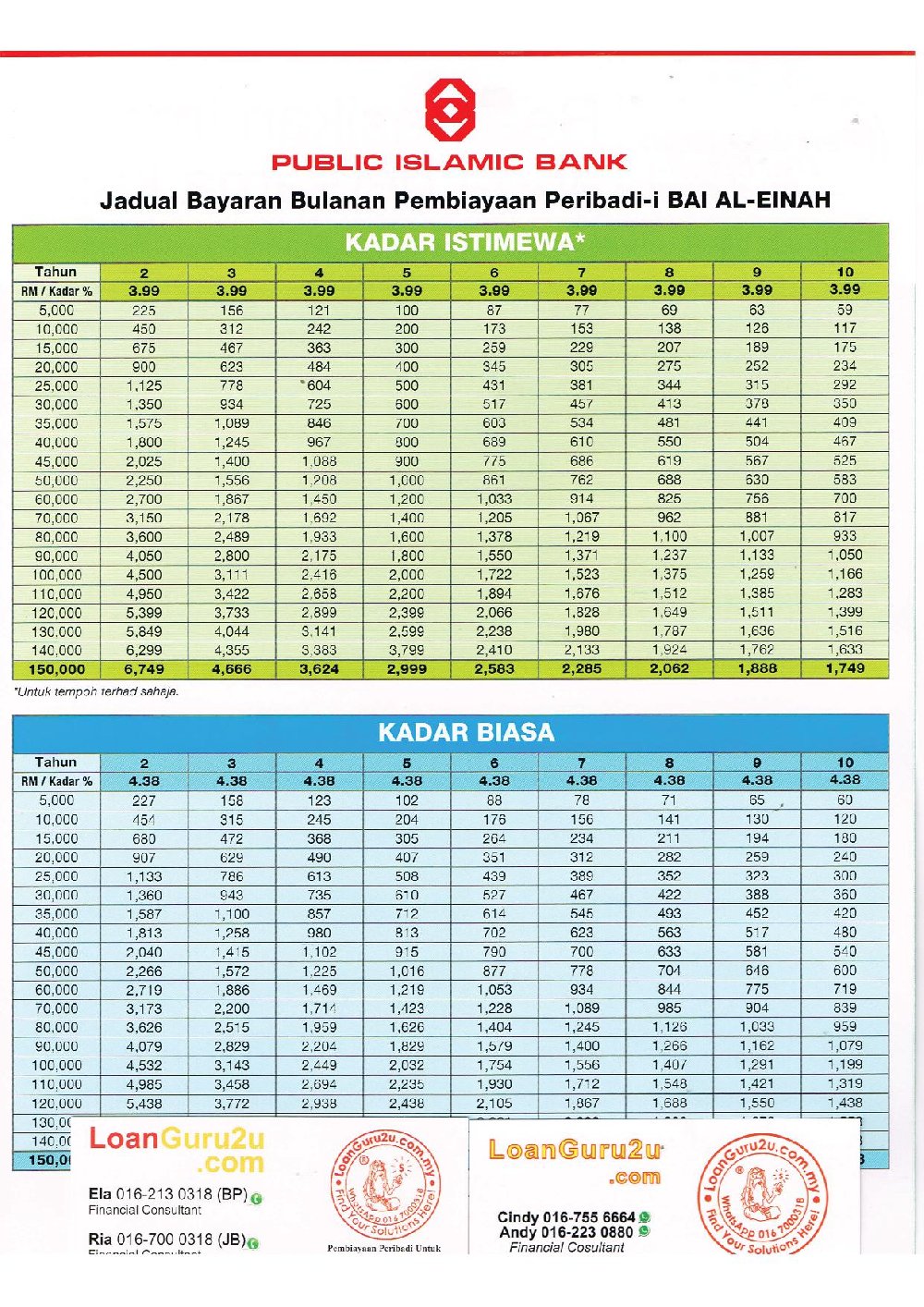

Rhb bank s loan approvals and loan disbursements are instant therefore it is ideal for people who need immediate funds. The maximum tenure for this personal loan is 10 years. Possibly a health crisis has actually come up at home or you require for some extra cash for major occasions such as a wedding or honeymoon. Jadual pemba aran balik bulanan 405 pi aman 5 70 peribadi 5 70 215 257 27 g 407 bae i 5 70 224 243 2gg 5 70 217 5 70 5 70 5 70 5 70 5 70 205 216 208 kadar 5 000 6 000 7 000 8 000 g ooo 10 000 11 000 12 000 13 000 14 000 15 000 16 000 17 000 18 000 lg ooc 20 000.

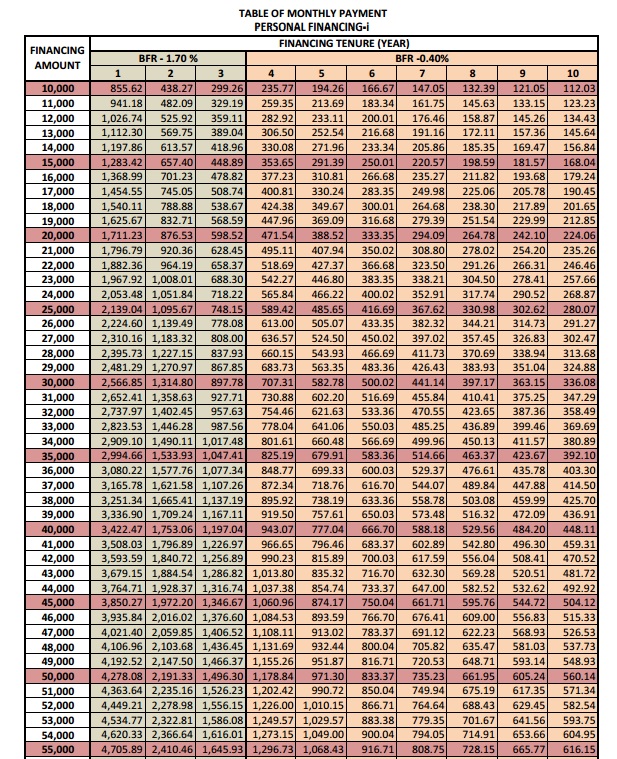

The minimum loan tenure is 2 years and the maximum will be 10 years. The margin of financing for public bank home loans can go up to 100 inclusive of legal fee stamp duty and mrta mortgage term reducing assurance financing. Perhaps you temporarily need a loan to make house renovations. Public bank also lowered its roe target to between 13 and 14 in 2019.

Based on the eligibility customers who apply for the loan will be eligible to get loans from rm 5 000 to rm 150 000 to ease customers payment method public bank. The low ratio is a testament to the banks good asset quality and prudent lending practices. Each of public bank s home loan plans offer a zero entry cost option. This personal loan is only offered to public sector employees from federal and state level government staffs.

Set up fee for homesave shopsave loan account. Public bank bae i personal loan table personal loans. Monthly maintenance fee for homesave shopsave loan account. You can also opt for redraw facility when you sign up to this particular public bank housing loan.

Public bank maintained its gross impaired loan ratio at 0 5 in 2018 which is far below the industry average of 1 5. Rm20 00 per request plus photostating charges with effect from 28 09 2018 13.