Overview Of Banking Industry In Malaysia 2017

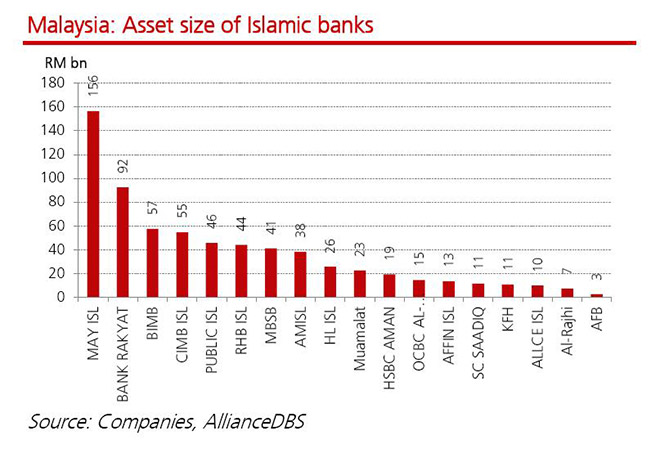

The malaysian banking sector comprised 54 banks as at the end of 2017.

Overview of banking industry in malaysia 2017. The banking sector in malaysia accounted for 4 7 of gdp in 2016 boasting assets worth 198 8 of gdp and a workforce equivalent to 3 of the total employed workers in the country in 2016. Some of malaysia s larger domestic banks have even managed to build a formidable presence. Hsbc bank malaysia berhad the largest foreign bank in malaysia with more than 60 branches and 4 000 employees. Incorporated in malaysia in 1994 the bank offers islamic financial services including personal and commercial banking.

A subsidiary of hsbc holdings plc hsbc bank malaysia berhad is the largest foreign owned bank in the country with a network of over 60 branches nationwide. Bank negara malaysia rm billion 2 0 2 4 6 8 10 12 14. Hsbc amanah is an islamic banking subsidiary of hsbc bank malaysia. This banking regulation guide provides a high level overview of the governance and supervision of banks including legislation regulatory bodies and the role of international standards licensing the rules on liquidity foreign investment requirements liquidation regimes and recent trends in the regulation of banks.

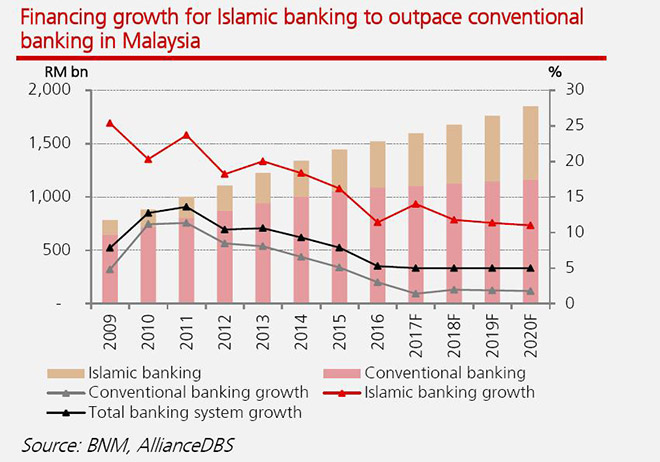

Customer satisfaction index 2017 banking industry executive summary a customer satisfaction index csi survey was conducted in 2017 to assess consumers experiences with services provided by banks in malaysia. Bank negara malaysia first quartile third quartile median aggregate 0 10 20 30 40 domestic commercial banks locally incorporated foreign banks islamic banks investment banks with large operations in malaysia bank financing grew at a moderate pace source. Rm 79 47 billion 2017 hsbc bank malaysia berhad. The malaysian banking sector scored an overall csi of 74 3 an improvement of.

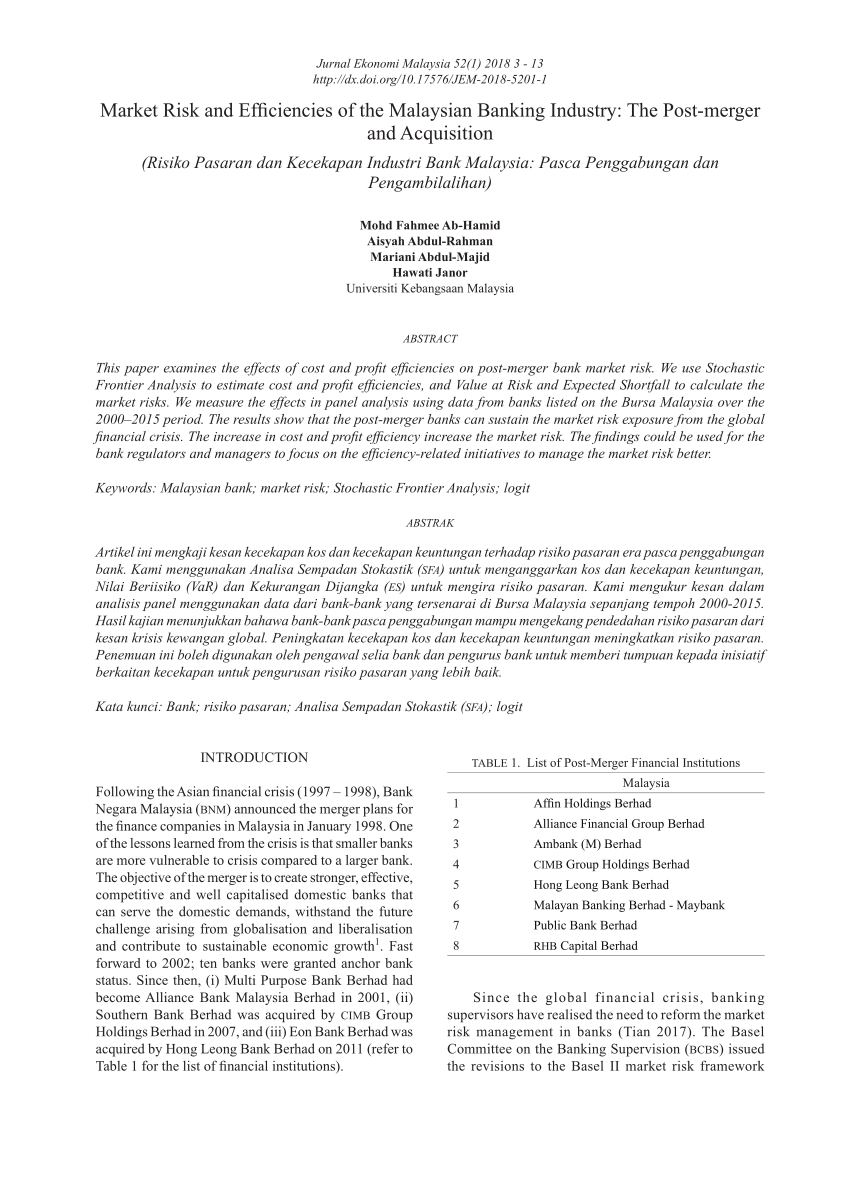

Bank negara malaysia the central bank of malaysia established in january 1959. Bank negara malaysia bnm reports that for 2014 a decade after the consolidation exercise the banking industry is reported to have a net profit rm32 billion with a 8 per cent contribution to the national income. While foreign banks been present in malaysia from the inception of the modern banking industry in the country domestic banks have come to dominate the country s banking sector. Data as at end 2017 source.

Services sector to see lower growth of 6 1 from 6 2 in 2017. To fully realize its human potential and fulfil the country s aspiration of achieving the high income and developed country status malaysia will need to advance further in education health and nutrition and social protection outcomes. Highlights of bank negara malaysia annual report 2017 economy to grow between 5 5 and 6 in 2018 versus 5 9 in 2017.