Double Entry For Hire Purchase Of Motor Vehicle Malaysia

This matches the cost to purchase the van to the income associated with the expense.

Double entry for hire purchase of motor vehicle malaysia. The double entry of the enter bill transaction. Assuming you purchase a new office equipment at 20 000 and. The accounting rules require us to record the cost to purchase the van over its useful life. Credit hire purchase 19 200.

There are fixed asset hire purchase creditor interest in suspense and hp interest expense accounts. But in book keeping we need to capitalise the asset at cost i e. To accomplish this we need to make an entry to account for depreciation. Purchased from maruti udyog ltd.

Credit hire purchase company. Delhi tourist service ltd. Net of the interests and state the liability to the hire purchase company in full i e. Cash price method under cash price method we are deal hire purchase transactions just like normal transactions.

How do you record the disposal of fixed assets in the following situations. A business has fixed assets that originally cost 9 000 which have been depreciated by 6 000 to the date of disposal. Moneyworks accounting software when purchasing office equipment or machinery business owner frequently use hire purchase to finance their purchases. Recording of the liability to the hire purchase company.

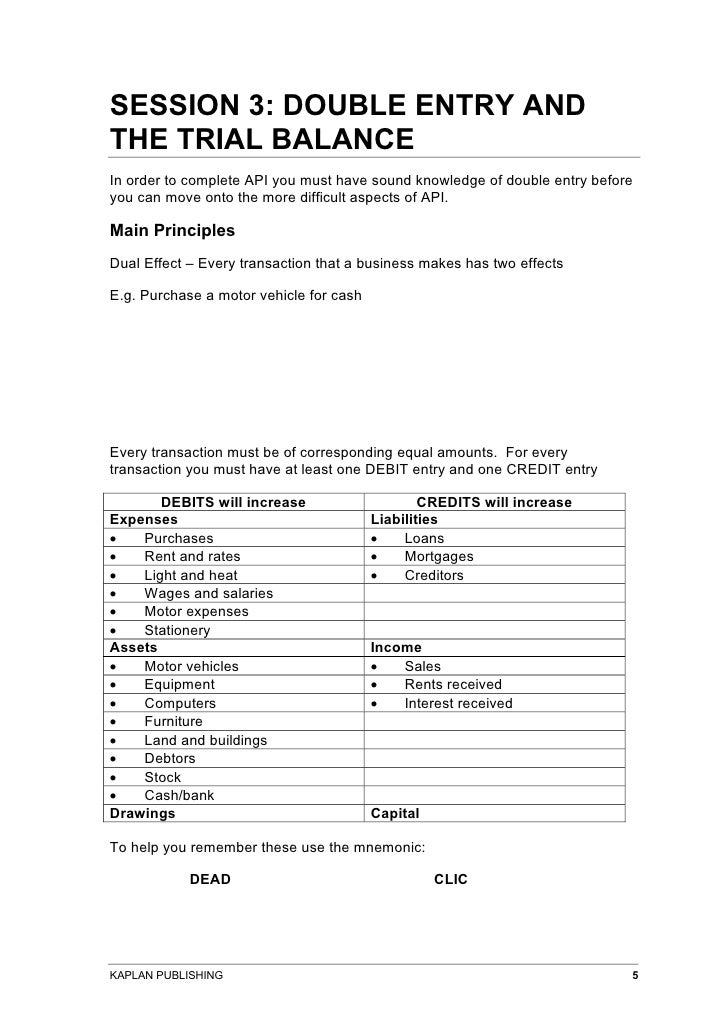

You create both the interest in suspense and hire purchase account as a long term liability since the payment term is more than a year. There are four methods of accounting for hire purchase. Debit cost of office equipment 15 000 debit gst input. When purchasing a motor vehicle often we made a down payment deposit and arrange the balances with a car loan.

The new motor vehicle 30 000 is brought into the business and the business makes a loss 1 000 on disposal of the old vehicle. The purchase was on hire purchase basis rs 50 000 being paid on the signing of the contract and thereafter rs 50 000 being paid annually on 31st march for three years interest was charged at 15 per annum. There are multiple accounts involved in hire purchase transactions. The fixed assets were sold for 2 000.

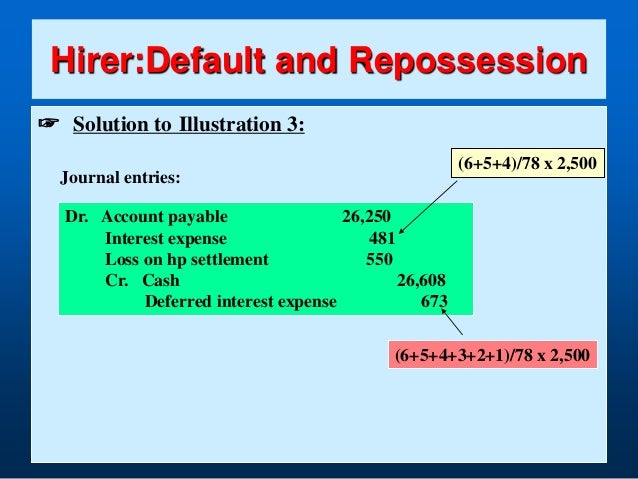

Use the purchase invoice transaction to recor. 1 050 debit interest in suspense. When transactions or event happen we record them. Disposal of fixed assets double entry example.

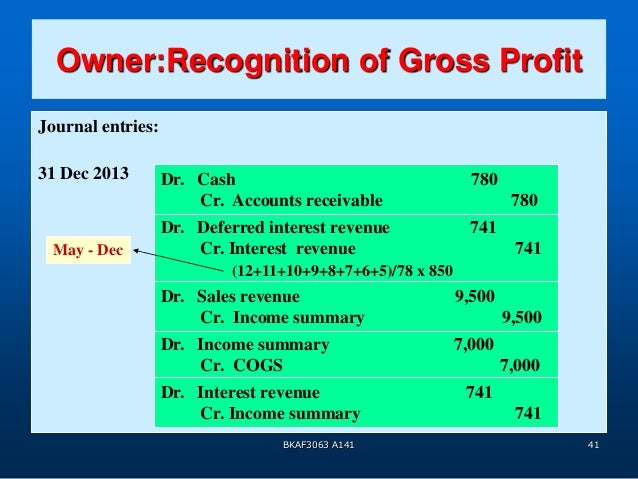

Vehicles are usually afforded a five year life. A motor van on 1st april 2009 the cash price being rs 1 64 000. This in itself is straight forward. Journal entries in the books of purchaser a for buying assets on hire purchase asset on hire purchase account dr.