Double Entry For Disposal Of Motor Vehicle Under Hire Purchase

Disposal of fixed assets double entry example.

Double entry for disposal of motor vehicle under hire purchase. I got the figure and hopefully you can help me. The van cost 50 000 and your business paid cash for the van. I have anothe vehicle adjustments account under equity section 3. Therefore the hp value at year end is.

Disposal of motor vehicle under hire purchase here it is my company disposed a car by transferring ownership to individual with no cash consideration. It balance s asset liability back to zero then let the account do the final adjustment as it may have capital gains if tradein is higher than depreciated. Let s assume that your business purchases a new van on january 1. Tradein vehicle is sold under misc vehicle sales and debited to asset acount for said vehicle.

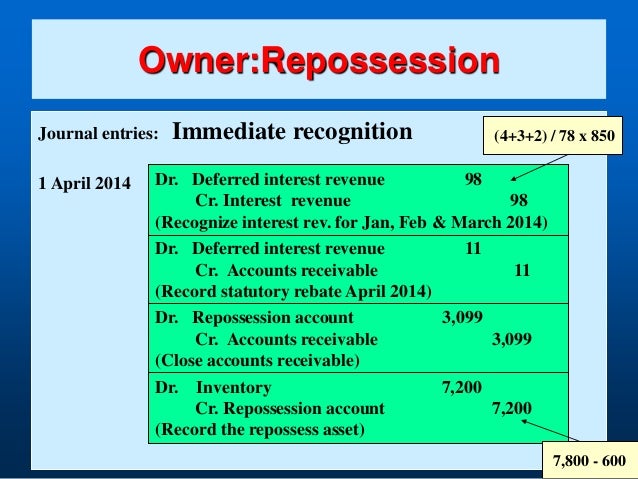

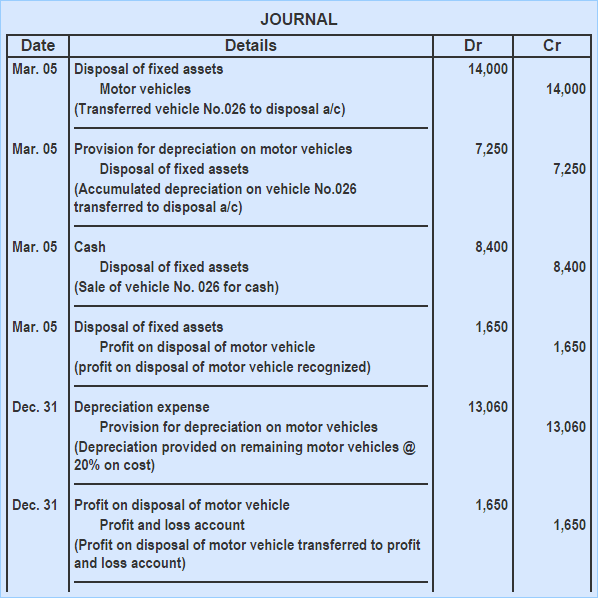

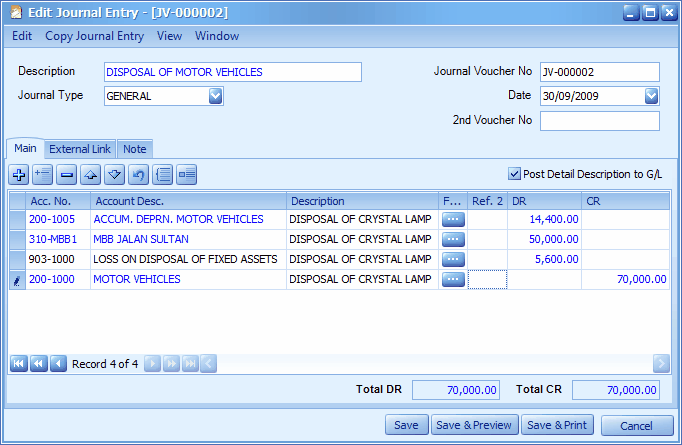

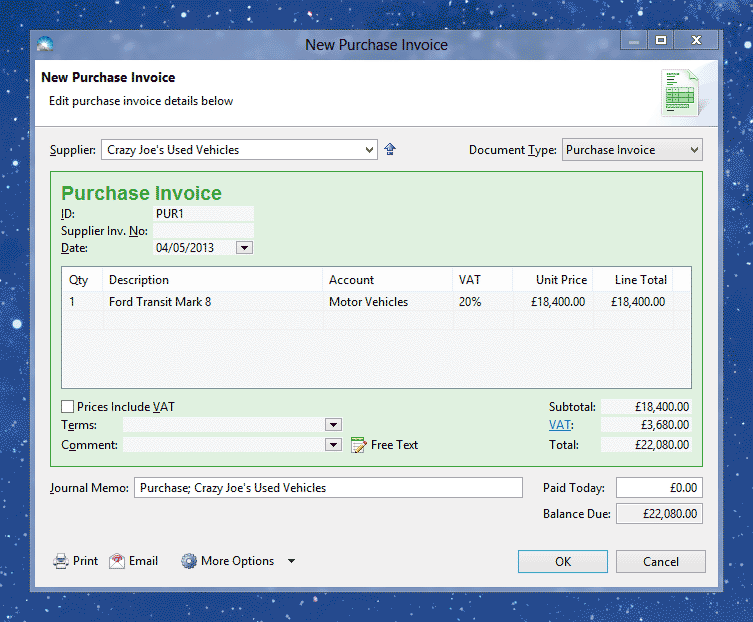

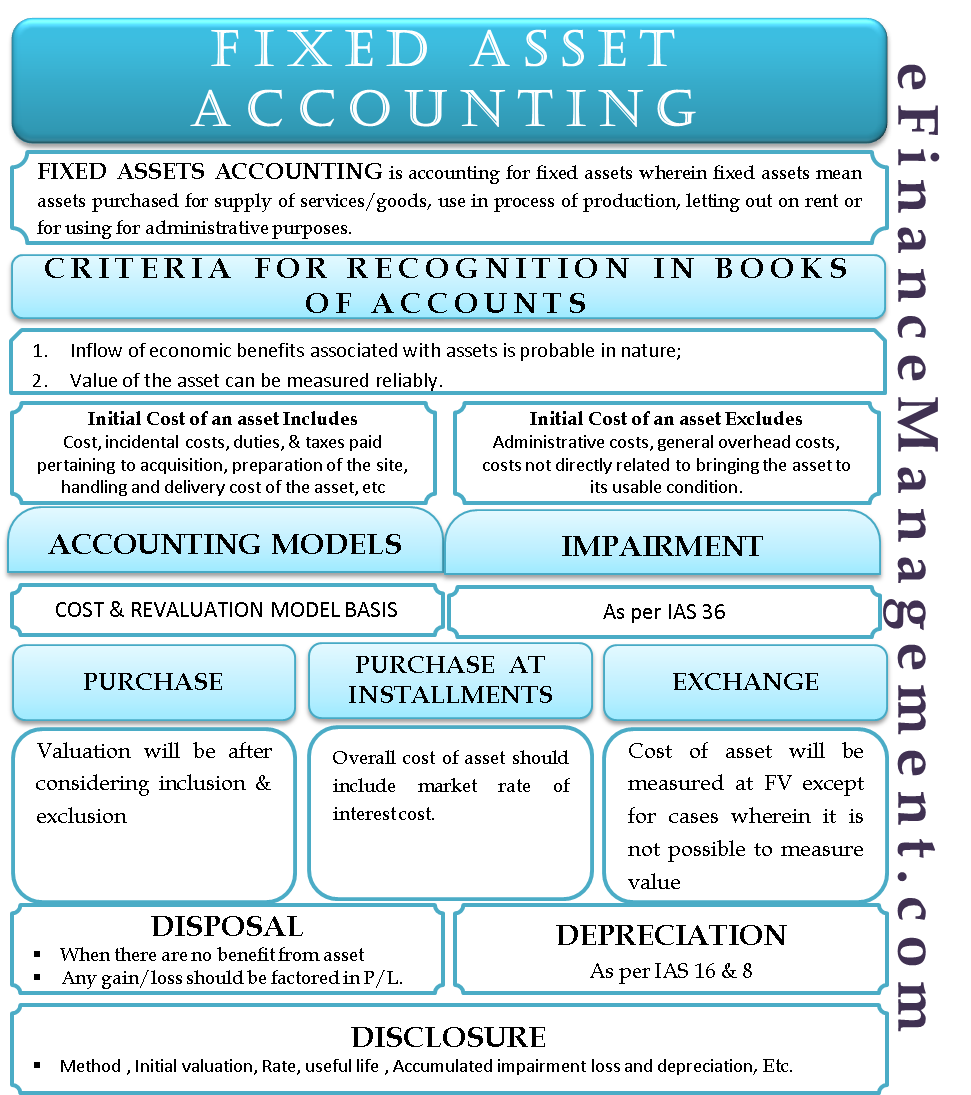

I now need to record the sale of the hire purchase in myob. And im not sure on how to capture the entry. I have recorded the sale of the vehicle with depreciation and loss already. A company may need to de recognize a fixed asset either upon sale of the asset to another party or when the asset is no longer operational.

A business will often purchase a number of long term assets for a single combined purchase price. The car was sold on 4 december 2014 and the total repayments to that date was 9 314 69. A disposal of fixed assets can occur when the asset is scrapped and written off sold for a profit to give a gain on disposal or sold for a loss to give a loss on disposal. This post considers an example of a vehicle purchase to show how to record the entries and the impact on the financial statements.

In order to record the assets in the accounting records and to allow depreciation to be correctly calculated the basket purchase price needs to be allocated in proportion to the fair market value of the assets. Credit the old vehicle 17 000 11 000 and the cash 25 000 leave the business and are used to pay for the new motor vehicle. This will need to be recorded as an asset so that. In each case the fixed assets journal entries show the debit and credit account together with a brief narrative.

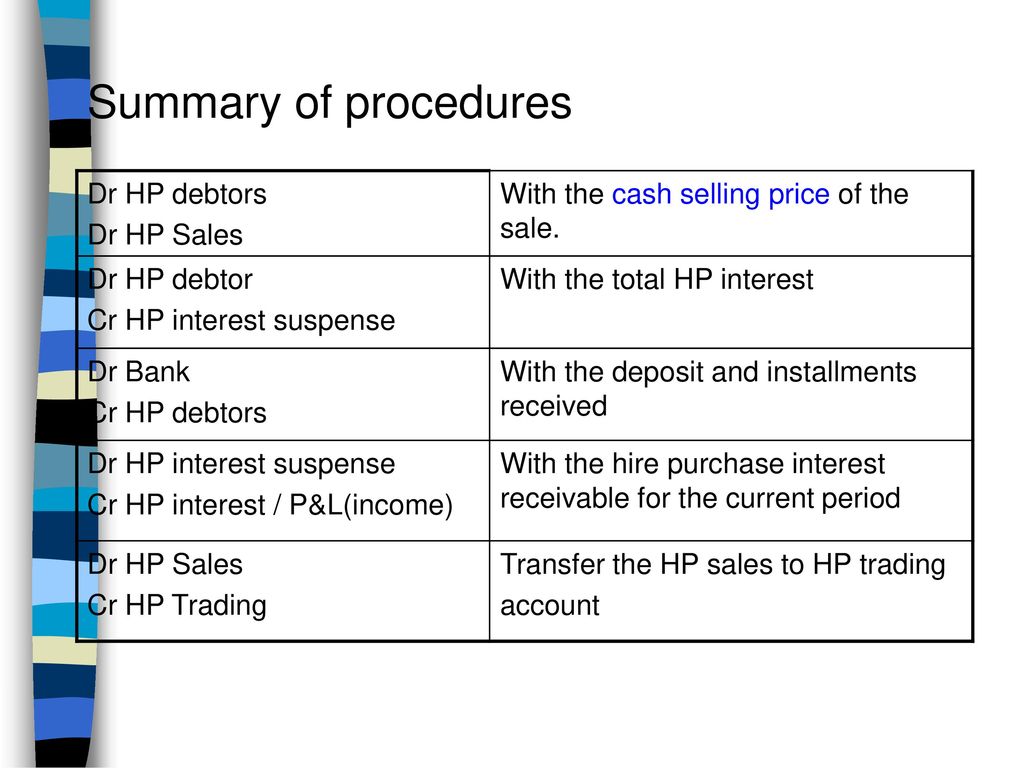

The hp loan is 50 807 40 which 9 919 37 is interest included in this 51k. The fixed assets journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of fixed assets. Double entry bookkeeping is here. The new motor vehicle 30 000 is brought into the business and the business makes a loss 1 000 on disposal of the old vehicle.